Also important are sentiment indicators such as Put/Call ratios, bull/bear ratios, short interest, Implied Volatility, etc. Other avenues of study include correlations between changes in Options (implied volatility) and put/call ratios with price. Examples include the moving average, relative strength index and MACD.

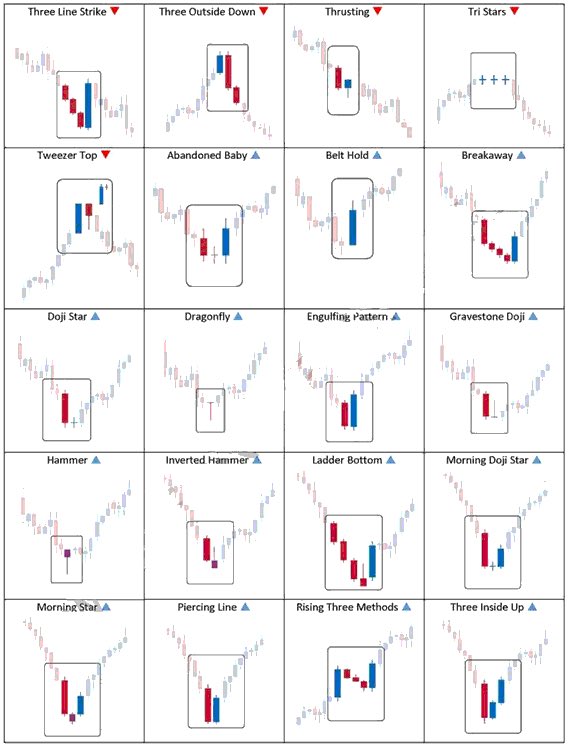

Technicians also look for relationships between price/volume indices and market indicators. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Technical analysts also widely use market indicators of many sorts, some of which are mathematical transformations of price, often including up and down volume, advance/decline data and other inputs. Technicians using charts search for archetypal price chart patterns, such as the well-known head and shoulders or double top/bottom reversal patterns, study technical indicators, moving averages and look for forms such as lines of support, resistance, channels and more obscure formations such as flags, pennants, balance days and cup and handle patterns.

Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. As such it has been described by many academics as pseudoscience.įundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results.

In finance, technical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume.īehavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory.

0 kommentar(er)

0 kommentar(er)